W11_Hilal_Estimating Cost At Completion (Part 4)

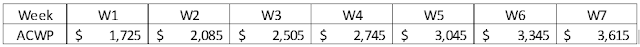

Problem Recognition Estimate at completion is really important to management in order to forecast the time and cost at project completion. These series of blogs were created to discuss each method individually and then in this blog will compare the results and select the best alternative. Feasible alternative The Guild of Project Controls Compendium and Reference suggest using three main forecasting/ estimation techniques: - Independent estimate at completion (IEACs) - Monte Carlo Simulation - Best Fit Analysis of Alternatives a. IEACs: BAC, BCWP, and ACWP are used along with CPI and SPI values in order to calculate the EAC for different scenarios. b. Monte Carlo Simulation: BAC is used as starting point and allow for random function with 0.5% difference from the original value. This is repeated 1000 times in order to generate an average, maximum and minimum values. c. Best Fit: ACWP data points are used to plot th