W3_ISHAQ_Money_Investment

Problem Definition

In my last blog, I used the Grid

Analysis Technique to analyze the alternatives of the land location to build my

home. Dr. PDG encouraged me to use one of the Multi-Attribute Decision making

models. I have gone through the different models and in this blog I’m going to

use the compensatory model to analyze my new problem. These days I have some

money that I’m collecting to build my new home. I’m planning to start the

construction after six months so, I’m looking to invest it.

Development of Feasible Alternatives

There are three investment opportunities that

I am thinking to compare. They are buying:

1. a real estate

2. shares from the exchange (from existing listed companies in the

shares market)

3. participation in a new Initial public offering

Development of the Outcome for Alternative

My objectives in selecting the investment

opportunity will be an investment that makes profit in a short period,

convenience investing and with low risk. So, I adopt these attributes as the

outline to make my final choice.

Selection of Criteria

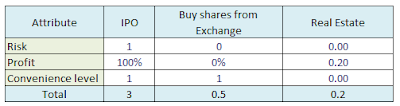

Table 1 lists the comparison for the three

alternatives. The risk level are as per my experience in the shares market.

Analysis and Comparison of the

Alternative.

Using the compensatory approach, which consists

of two models: Non-Dimensional Scaling and Additive Weighting Technique, the

following results are calculated.

- Non-Dimensional Scaling

Table 2. Dimensionless

Scoring model

Table 3. Dimensionless

Relative Weighting

Using the quantitative comparison for each

attribute in table 2, the total score is calculated to represent the rank of an

alternative (table 3). Using the non-dimensional scaling, the IPO scored the

highest rank with a total score 3 which is 6 times better than buying shares

from the exchange.

2.Additive Weighting Technique

Table 4 below, shows the calculation using the

additive weighting technique, where ranking the considered attributes by giving

higher rank to the preferred attribute. The totals show that IPO ranked the

highest value as the best option.

Table 4. Additive

Weighting Score

Selection of the Preferred

Alternative.

Both compensatory techniques show that the

Initial Public Offering is the best alternative to invest the money.

Performance Monitoring and the Post Evaluation

of Result.

It is important to understand how to compare

between a set of alternatives. Also, having more attributes may help in

determining the preferred alternative.

References

1. Afshari, A., Mojahed, M., & Yusuff, R. M. (2010). Simple

additive weighting approach to personnel selection problem. International

Journal of Innovation, Management and Technology, 1(5), 511.

2.

GUILD OF PROJECT CONTROLS COMPENDIUM

and REFERENCE (CaR) | Project Controls - planning, scheduling, cost management

and forensic analysis (Planning Planet). (n.d.). Retrieved from http://www.planningplanet.com/guild/gpccar/managing-change-the-owners-perspective

(accessed 20/21 November 2017)

3.

Yakowitz, D. S., Lane, L. J., &

Szidarovszky, F. (1993). Multi-attribute decision making: dominance with

respect to an importance order of the attributes. Applied

Mathematics and Computation, 54(2-3), 167-181.

Good job, Ishaq!!! Too bad you didn't include Bitcoin and Gold into the Feasible Alternatives!!!!

ReplyDeleteWhile these are really great case studies, given that generating a Return on Training Investment for OPWP is one of the key objectives, while I am more than happy to see you using the tools and techniques to solve real problems, aren't there ANY from your working environment that you could select that would help us meet the objective of being able to demonstrate to your management that the savings you made more than paid for the cost of this course? Remember the 64 million dollars that Mr. Teguh saved Freeport? And won him a position as a Vice President of the company? THAT is where I want to see all of you ending up.

BR,

Dr. PDG, Jakarta